arkansas estate tax statute

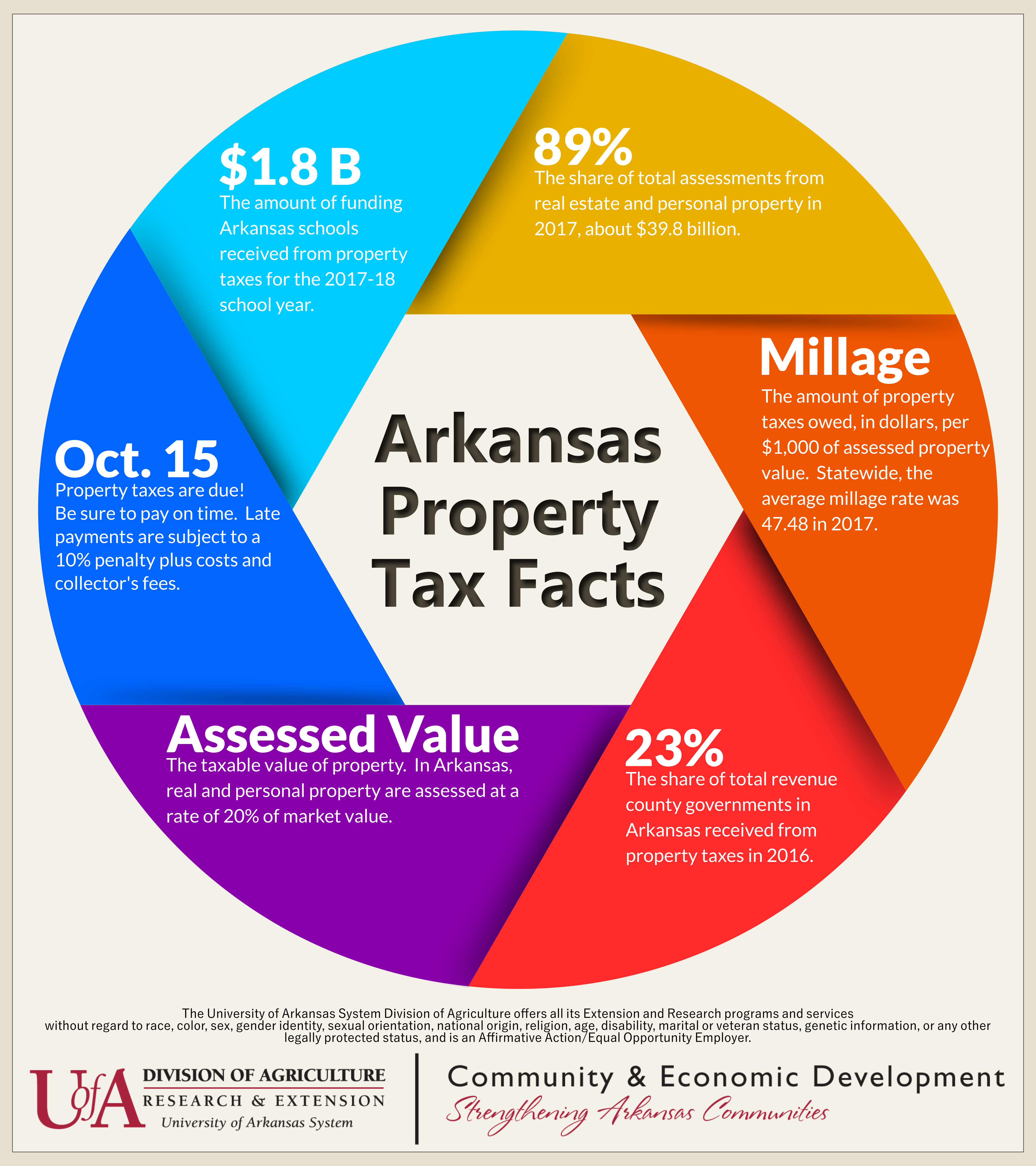

The amount of taxes due annually is based on the assessed value of the property. In Arkansas the median property tax rate is 620 per 100000 of.

Arkansas Inheritance Laws What You Should Know

But property taxes are a little bit on the low side.

. Of all taxes collected in Arkansas state and local combined 181 percent comes from property taxes. Arkansas state income tax rates range from 0 to 59. Retired law enforcement officers working on cold cases can claim an income tax credit of up to 3500.

Home Excise Tax Miscellaneous Tax Real Estate. According to Amendment 79 the taxable value cannot exceed. A It is the intent of this act that the following objectives shall apply to the operation of the property tax system for Arkansas taxpayers.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Children inherit 23 of personal property and all real. Justia US Law US Codes and Statutes Arkansas Code 2010 Arkansas Code Title 26 - Taxation Subtitle 5.

In Arkansas the probate process is mandatory for any contested estate if there are creditors including a mortgage and for any estate larger than 100000. Select Popular Legal Forms Packages of Any Category. They have a an overall rate of about 6.

Spouse inherits 13 of personal property and inherits 13 of real property in the form of a life estate. 3500000 and a portion of the property. Arkansas does have a relatively high.

Assess Pay Property Taxes. Fiduciary and Estate Income Tax Forms 2022. Online payments are available for most counties.

AR1002ES Fiduciary Estimated Tax Vouchers for 2022. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. At the federal level the federal gift tax makes an exclusion of 15000 per year per gift recipient.

Pay-by-Phone IVR 1. Spouse and children. The State of Arkansas does not have a property tax.

All Major Categories Covered. If the estate exceeds the 1206 million exemption bar the Federal Estate Tax that can reach up to 40 may significantly reduce your inheritance. 1 To be taxed fairly and.

AR K-1FE - Arkansas Income Tax. 26-59-102 - Definitions. As far as gift taxes go Arkansas also does not have a state gift tax.

When a property owner fails to timely pay the assessed tax the property may become subject. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. A Team Exclusively Focused on Tax Filing and Legacy Planning for UHNW and HNW.

The tax rate is progressive with it top tax rate of around 7. 2014 Arkansas Code Title 26 - Taxation Subtitle 5 - State Taxes Chapter 59 - Estate Taxes 26-59-101 - Title. However Arkansas cities and counties do collect property tax which is the principle local source of revenue for funding public schools.

Locate contact information for your county assessor and tax collector. Thats the fifth lowest in the nation where the average is 31 percent and. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more.

Estate tax returns generally. Likewise 17 states exercise their own estate tax laws so consider this in your estate plan. A Team Exclusively Focused on Tax Filing and Legacy Planning for UHNW and HNW.

26-59-103 - Chapter to remain in effect while federal. Most states with an estate tax base their rate on the federal estate tax. Real Property Transfer Tax applies to transferring ownership of mineral rights.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Learn about Arkansas income property and sales tax rates to estimate what youll pay on your 2021 tax return. Limit for Other Properties eg commercial vacant or agricultural 5 a year until the propertys full.

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Is There An Inheritance Tax In Arkansas

Tax Deed Properties In Arkansas The Hardin Law Firm Plc

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Sponsored Deferring Real Estate Tax Gains Can Be An Effective Tax Strategy Arkansas Business News Arkansasbusiness Com

Homestead Tax Credit Real Property Aacd

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Arkansas State 2022 Taxes Forbes Advisor

Governor Delays Call For Session On Tax Cut Plan

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf